Shifting from Superpower Factories to Superpower Classrooms: The New Landscape of Global Manufacturing

Input

Changed

China’s dominance in manufacturing now rests on its vast talent pipelines, not just efficiency Western economies risk losing ground unless education and training systems compress time-to-competence at scale Factories of the future will be decided in classrooms as much as on shop floors

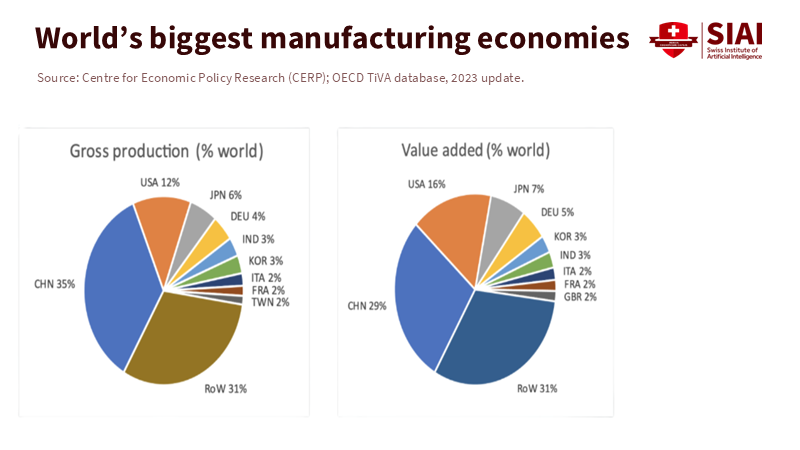

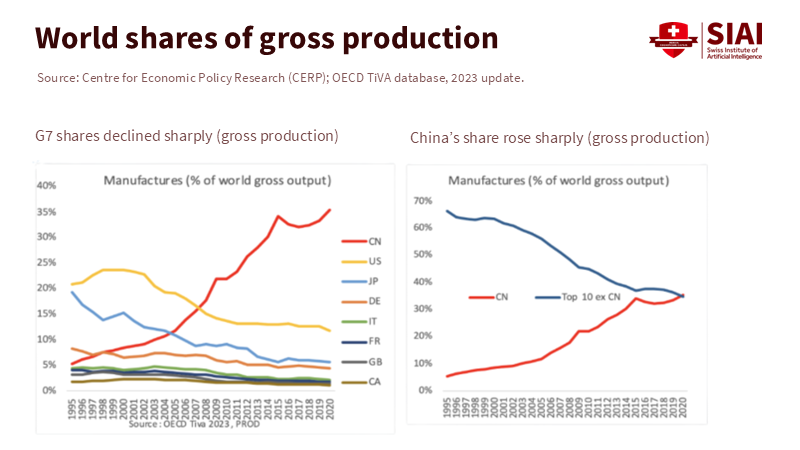

In 2023, China made up about 29% of global manufacturing output, a share larger than the combined totals of the next four manufacturing economies. This figure is more than just a market share; it reflects an operating system. It indicates who sets process standards, disciplines global prices, and decides which skills will be valued in the next wave of factories. Viewing this situation solely through the lens of efficiency—or believing that tariffs and industrial subsidies can effectively change the outcome—misses the real driver behind it. Today, manufacturing success depends on scale and speed in training talent. The "factory of the world" has evolved into a hub for practical engineering, mechatronics, power electronics, and production software. Suppose the United States and other major manufacturing nations—Germany, Japan, and South Korea—don’t treat education and training as part of their industrial strategy. In that case, they risk losing their technical advantages. The focus has shifted from “protect vs. open” to whether we can create classrooms that match factories in terms of output, quality, and the time taken to develop skilled workers.

The race has moved from plants to pipelines

A significant mistake in current policy is treating today’s bipolar order as a repeat of the last Cold War. Back then, U.S. productivity exceeded that of rivals, and scale followed efficiency. Now, in manufacturing, the relationship often works the opposite way: scale promotes efficiency by shortening learning cycles and spreading the cost of automation. In 2023, China installed 51% of the world’s new industrial robots and ranked third globally in robot density, surpassing Germany. This scale impacts curriculum and workplace learning in ways that tariffs can’t address: every extra tool on a production line serves as a teacher. Meanwhile, U.S. manufacturing productivity growth has remained near zero or even negative from 2010 to 2022. This stagnation cannot be disguised by protection if training, supervision, and process engineering don’t keep up. The takeaway is clear: talent pipelines—not just semiconductor facilities or tariff programs—are the central area of competition.

The second oversight is focusing only on factories while ignoring schools. China operates the most extensive vocational education system in the world, with over 9,700 secondary vocational schools catering to around 17.8 million students and more than 1,500 higher vocational colleges preparing technicians and associate engineers. At the top of the educational pipeline, China was still the largest source of international patent applications in 2024, producing STEM graduates and engineers at a scale that supports significant improvements in processes. When a nation combines widespread robot use with extensive technical training, it creates compounding benefits: new employees arrive ready to work, supervisors learn faster, and suppliers standardize to domestic norms that later become global benchmarks. Germany, Japan, and South Korea still excel in certain niche areas—Korea leads in robot density—but in fields requiring mid-to-high complexity production, China has accelerated the skill-acquisition process. Western policies will fail if they assume that better efficiency alone will suffice without improving educational throughput.

Scale and speed, quantified—and why they matter for schools

Consider the clean-energy sector, where price discipline is now a crucial factor. In 2024, China produced over 75% of the world’s batteries, with domestic prices dropping nearly 30% in just a year. By 2030, committed battery capacity will exceed China’s domestic demand by more than double, maintaining pressure on export prices and establishing standards from slurry mixing to formation cycling. Additionally, China saw more than 276,000 robot installations in 2023, making up half the global total, while local robot makers expanded their market share, creating a strong ecosystem of service engineers and integrators. When prices fall rapidly and hardware changes quickly, educational programs need to update every year, not just once every accreditation cycle. The benchmark for an effective school is no longer simply about aligning with industry; it’s about evolving alongside production technology, demonstrating the need for continuous updates in educational programs.

The same pressures affect U.S. institutions, though in subtler ways. The United States still excels in advanced R&D and many high-value sectors, but the path for turning inventions into production is uneven. Participation in apprenticeships has increased, with about 680,000 active apprentices, up from roughly 318,000 a decade ago. The CHIPS and Science Act is mobilizing workforce groups, matching funds from states, and community college pathways. Still, the figures are small compared to the task at hand. Semiconductor workforce initiatives amount to hundreds of millions of dollars across states, and individual factories are testing apprenticeships. However, technician demand runs into the thousands for each large facility, requiring considerable experiential learning. Without a reliable pipeline producing thousands of skilled mechatronics and process technicians each year, the U.S. risks creating high-quality facilities with limited talent pools to draw from, underscoring the need for a robust pipeline of skilled workers.

A third challenge is soft power. The last Cold War was influenced as much by the credibility of American systems as by output per hour. Today, U.S. official development assistance decreased in 2024. Aid politics have become unstable, with discussions about freezing or canceling billions in congressionally approved funds and public debates about restructuring USAID. Regardless of whether every proposal survives legal challenges, the message to partner governments and universities is clear: plan for uncertainty. This is essential for education, as international partnerships—such as faculty exchanges, standards development, TVET modernization, and credential recognition—create a vital network that enhances skills on a large scale. When this network weakens, the West loses ground not only in diplomacy but also in spreading the educational programs necessary for our factories to remain competitive.

An education-first industrial strategy

If the geopolitical landscape will be shaped by which countries train and upgrade their workers the fastest, the counter-strategy for the U.S., Germany, Japan, and South Korea isn’t to long for a labor-intensive past; instead, it’s to precisely redesign how we train technicians, process engineers, and factory-floor leaders. The goal should be to cut the time from classroom to competent practice by half within five years in key areas—batteries, power electronics, robotics integration, precision machining, and advanced packaging. To achieve this, we need three key steps. First, transform community colleges and technical schools into applied manufacturing institutes with capital cycles and vendor relationships resembling those of factories. A practical model is the semiconductor workforce networks now emerging under CHIPS, which serve as national coordination hubs, state co-funded efforts, vendor-supported equipment, and paid apprenticeships linked to specific employer needs. This model should expand to include batteries and industrial automation. Reporting here is straightforward: by utilizing NIST and state disclosures, we can track over $300 million in new state workforce commitments and more than $200 million in private training investments supported by federal policy. An initiative for battery automation using the same framework could reach a similar scale if co-funded by major firms.

Second, make apprenticeships a standard pathway into advanced manufacturing careers. Germany’s dual system shows that the quality of training is as vital as its quantity. Yet, Germany is facing gaps in placements and demographic challenges. In the U.S., registered apprenticeships are growing across various sectors, but programs remain scattered. The practical aim is not to replicate a foreign model entirely but to ensure that significant public manufacturing investments include enforceable apprenticeship ratios and vendor-supported training aligned with the equipment being used. Based on 2024 figures—around 680,000 active apprentices—a ten-year goal of doubling advanced manufacturing apprentices while providing incentives for completion and pathways into applied bachelor’s programs is reasonable if linked to procurement and grants. This aligns with employer demands noted in investments in chips, energy, and rail, and it would create a skilled workforce that supports elite engineers.

Third, treat curriculum as a supply chain. Rapidly changing production areas—such as battery cells, drives, and power semiconductors—require yearly refresh cycles and shared “golden” process modules. China holds an advantage not only in volume but also in speed of updates. As robot density increases and PCT filings lead the way, new process knowledge spreads quickly through colleges and technical institutes. The West must establish an ongoing system to document vendor-independent labs for formation cycling, dry-room operations, mixed-robot programming, and inline metrology, along with micro-credentials valued by employers. A practical observation: given the current rapid decline in battery prices (almost 30% in China in 2024), the cost of not updating curricula fast enough is significant—graduates are trained on yesterday’s processes and struggle to perform well on tomorrow’s production lines. A federal-state “curriculum fast lane” with twelve-month update deadlines linked to funding would give pedagogy the same attention we apply to procurement.

One concern is that we can't "out-China China" on scale; another points out that Korea and Japan excel in specific niches; a third argues that automation leads to fewer manufacturing jobs. Each of these points has merit. However, the aim isn't to mimic China’s scale; it's about rebuilding our strengths where the learning curves are steepest. Korea’s leading robot density and Japan’s precision in machinery demonstrate what mature systems can achieve, but both now face shrinking young populations and challenges in apprenticeship markets. The U.S. remains a research powerhouse, and its advanced R&D pipelines—like NSF, NSTC, and corporate labs—are tangible assets. The missing link is a strong middle-skill workforce that bridges these frontiers. Even in highly automated facilities, tasks such as configuring cells, troubleshooting movement plans, and refining inline analytics require human expertise, and these roles are often better paid than traditional shop-floor jobs. If we train people for these positions in large numbers, productivity can grow with automation rather than push employees out without enhancing output.

A second critique is that soft power has little to do with how factories perform. This view overlooks how aid and educational partnerships shape standards. When U.S. development finance or technical assistance helps a partnering country improve its TVET system, the outcome usually includes a group trained on U.S. equipment, software, and quality standards. If aid is cut or agencies undergo restructuring that slows down program execution, other providers may influence those standards. This is not an argument for any specific institutional setup; it serves as a reminder that curriculum changes within the global manufacturing system do not happen independently. As OECD data indicate, global official development assistance declined in 2024, and the share of national income the U.S. dedicates to aid—around 0.22% of GNI—lags behind its peers. In a contest for skills, that difference is significant; it serves as a strategic factor.

Lastly, there’s a belief that financial resources overshadow factories, and that the dominance of the dollar can weather any shocks. In the short term, strong capital markets matter; in the long term, those who build products shape both the technical landscape and bargaining power in standards, export controls, and supply chain management. China's surplus-driven position in trade is not just a big-picture issue—it reflects the contributions of hundreds of thousands of process engineers and technicians who can quickly and cheaply ramp up production. Suppose we can’t develop a similar group of skilled workers for our priority sectors. In that case, we should prepare for ongoing price pressure that will continue to erode our market share and diminish our ability to influence the next industrial era. The lasting response to a manufacturing superpower isn’t a tariff plan; it's an education plan that speeds up progress beyond the introduction of new machinery.

The number that every education minister should focus on

In ten years, a 29% figure for global manufacturing output may seem outdated unless education policies undergo a significant shift. The West’s error would be to address a scale and speed challenge with niche programs and intermittent industrial deals. The necessary work won’t be glamorous but will be more impactful: reducing time-to-competence, expanding apprenticeships with enforced ratios, updating curricula every year, and connecting R&D to middle-skill training so that fresh ideas translate into practical applications by skilled workers. If we accomplish that, the bipolar order won’t become a one-sided classroom; it will evolve into a competition of educational systems as much as tariff arrangements. Our call to action is clear: assess success by how many students can operate processes, troubleshoot production cells, and improve yield within twelve months of enrollment, and support only initiatives that drive that goal forward. During the last Cold War, the U.S. prevailed through efficiency. If we want to succeed—or at least maintain our standing—in this current landscape, the effectiveness of our factories will depend on what happens in our schools.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Arizona Commerce Authority. (2024, Nov. 19). TSMC Arizona announces expansion of registered technician apprenticeship program.

Arizona Office of the Governor. (n.d.). Advanced manufacturing and semiconductor workforce.

Axios. (2025, Sept. 8). Trump appeals foreign aid freeze to Supreme Court.

Baldwin, R. (2024, Jan. 17). China is the world’s sole manufacturing superpower: A line sketch of the rise. VoxEU/CEPR.

Brookings Institution. (2025, Feb. 4). What comes after a USAID shutdown?

Cedefop. (2024). Vocational education and training in Europe: Germany.

ChinaPower (CSIS). (2025). Measuring China’s manufacturing might.

Conference Board. (2023, May 17). Global productivity growth set to disappoint again in 2023.

Houston Chronicle. (2025, Sept.). Local unions invest in paid apprenticeships.

IEA. (2025, Mar. 5). The battery industry has entered a new phase.

IFR – International Federation of Robotics. (2024, Sept. 24). Record of 4 million robots working in factories worldwide.

Maricopa Community Colleges & partners. (2024). TSMC Arizona community impact report. NIST.

NIST. (2025, Jan. 15). Building the U.S. semiconductor workforce: January 2025 update.

OECD. (2024–2025). Trade in Value Added (TiVA) 2023 edition and 2023 nowcasts.

OECD DAC. (2025, June 11). Development Co-operation Profile: United States (2024 preliminary ODA).

U.S. Department of Labor. (2025, Jan. 23). New stats on registered apprenticeships (FY2024). Community College Daily.

UNIDO. (2024). World manufacturing production quarterly reports (Q2–Q4 2024).

Washington Post. (2025, Sept. 8). Trump administration asks Supreme Court to allow freeze on billions in foreign aid.

WIPO. (2025, Mar. 17). Use of WIPO’s global IP registries grew in 2024; China remains top source of PCT filings.

Xinhua/State Council portal (English). (2024, Mar. 27). China trains new-generation workers on vocational education.