When Tariffs Don’t Buy Strength: Why the Dollar Fell, and What the Models Missed

Input

Changed

Tariffs in 2025 weakened the dollar instead of strengthening it Markets priced in retaliation, limited U.S. manufacturing capacity, and credibility risks The lesson: tariffs act like a domestic tax unless tied to clear investment and trust

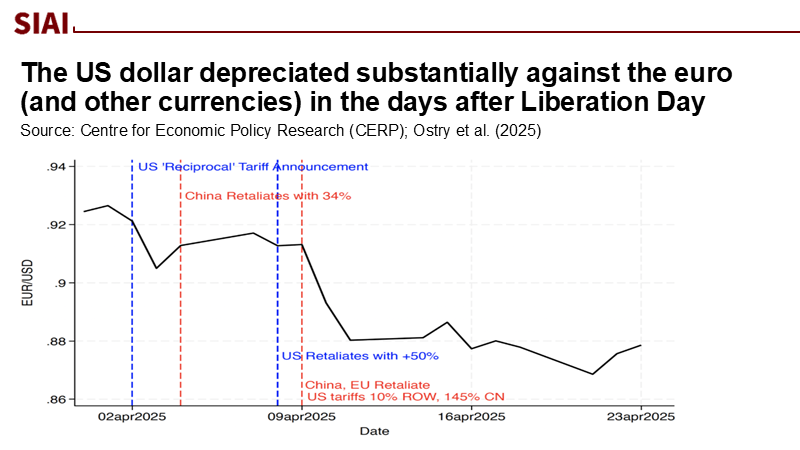

The single most revealing market fact of 2025 is not a tariff rate but a currency move. In the days after the broad U.S. tariff announcement on April 2, the dollar slid to multi-month lows against major peers, a move documented by real-time wire coverage; by June 30, the Financial Times reported the greenback’s worst first-half performance since 1973. This outcome, a direct result of the market's reaction to the policy set, rattled those who learned that import tariffs should appreciate the home currency by compressing imports and widening the trade balance. The decline was not a tantrum; it was a verdict. In that world, a weaker dollar is not paradoxical—it’s predictable.

What the standard story leaves out

The classic prediction—tariffs make the currency stronger—rests on two fragile assumptions. First, the tariff must meaningfully compress import demand. Second, domestic producers must be ready to replace foreign supply at higher margins. Both were poor descriptions of 2025 America. Manufacturing value added accounted for roughly 9.7% of GDP in Q1 2025, and factory capacity utilization has been running below its long-run average—about 77–78% in midsummer, approximately two points under the historical norm. That combination—small base, visible slack—limits rapid import substitution without price pressure. Tariffs thus behave less like a terms-of-trade coup and more like a broad sales tax on U.S. buyers in the near term.

Incidence evidence backs this up. Micro-studies of the 2018–2019 trade war found near-full pass-through of U.S. tariffs to import prices, with exporters essentially not “eating” the levy; retail prices rose accordingly. Those results, by Amiti, Redding, and Weinstein and by Cavallo, Gopinath, Neiman, and Tang, remain the cleanest border-to-store evidence we have—and there’s no reason to believe the physics changed in 2025. Early trackers this year likewise show tariff costs borne by U.S. importers and consumers, with tariff revenue literally collected from U.S. businesses at the border. Put simply: the short-run tax bill sits at home, not abroad.

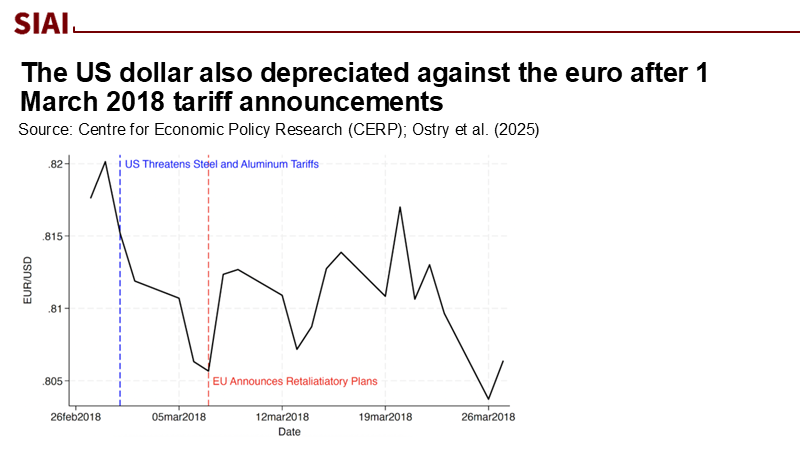

Retaliation and circumvention are the second blind spot. When partners respond—or credibly threaten to—the home-currency appreciation impulse is damped or even reversed as export prospects dim and portfolio flows rebalance. An event-study using high-frequency data around April 2 shows precisely this: the dollar depreciated on impact, and foreign equity portfolios shifted away from U.S. assets. At the same time, supply chains went to work. Mexico has edged into the top slot among U.S. trading partners. At the same time, China’s exports to Mexico surged to ≈approximately 21% of Mexico’s imports in 2024—a classic triangular trade that relabels the customs paperwork but not the physics of global value chains. The U.S. Census’s partner tables and Dallas Fed analyses trace that rerouting in real time.

A third omission is composition. The 2025 tariff schedule landed heavily on capital goods and intermediate inputs, raising costs for U.S. producers across tradables and non-tradables. Several independent model runs estimate meaningful near-term effects on goods prices and household purchasing power even before any second-round dynamics from monetary policy. However, when one parses the precise number, the direction is consistent with the border pass-through results and with business surveys that report delayed capital expenditures and selective output cuts in tariff-sensitive sectors. In short, the tariff tax bites domestically first, while any capacity response takes time and money.

Portfolios, credibility, and the reserve-premium channel

Traditional trade-centric models also underweight the impact of portfolio behavior. April delivered an unusual co-movement: the dollar softened even as long-dated Treasury yields rose. New work by Acharya and Laarits attributes that to an erosion of the Treasury “convenience yield”—the safety-and-liquidity premium investors pay for Treasuries—after the tariff shock, as the stock-bond covariance flipped sign and the hedging value of long bonds waned. A BIS event-study corroborates the chronology: the April 2 shock triggered sharp moves across FX and rates that gradually retraced as markets priced carve-outs and diplomacy, but not before the reserve-premium signal registered. Financial press coverage captured the same theme: the safety premium at the long end looked thinner in the weeks after April 2. When a policy bundle simultaneously threatens growth, clouds the fiscal/issuance path, and invites retaliation, investors demand more yield—and sometimes fewer dollars.

High-frequency evidence suggests that portfolios amplify the textbook channels. VoxEU’s April 15 analysis of the “Liberation Day” window argues that foreign equity investors rebalanced away from U.S. markets, pushing down the dollar on impact; contemporaneous Reuters coverage logged the currency’s slide to multi-month lows in early April, while the FT tallied the worst first half since the 1970s by June 30. The IMF’s April Global Financial Stability Report similarly flagged the tariffs as a catalyst for lower growth expectations and volatile cross-asset repricing. This bundle—a softer dollar, dearer long-term financing, and higher uncertainty—is not the recipe for swift re-industrialization. It is the market’s way of saying that the lever pulled won’t deliver the promised rebalancing on the promised timeline.

What about the claim that exporters will absorb the tariff over time, restoring the “good” version of the model? Sectoral news out of Japan’s auto industry did show temporary price-holding in the U.S. market as companies waited out negotiations. Still, guidance since mid-summer has emphasized margin pressure and pending price adjustments, alongside plans to expand U.S. production to mitigate the impact of tariffs on sales. That cadence—brief absorption to defend share, followed by pass-through or local capacity—is precisely what the 2018–2019 micro-evidence would lead us to expect. A similar story is emerging around Korea’s auto and battery supply chains as firms juggle new tariffs with long-horizon investment commitments.

What to do next—in classrooms and in policy

For educators, 2025 is a case study in why we must teach tariff episodes as integral to the joint events of trade and finance. Students should test three questions before predicting the sign of the exchange-rate move: Who pays at the border and at the store? How quickly can domestic capacity expand without pushing up prices? What does the long end of the yield curve say about credibility? The empirical building blocks are teachable and current: near-full tariff pass-through at the border and in retail prices; manufacturing’s ≈10% share of GDP and below-average capacity utilization; and high-frequency event studies that show the dollar’s depreciation alongside a rise in long yields as the convenience yield ebbed. Working directly with BEA, Fed, and tariff-tracker datasets can turn theory into reproducible inference for students in macro, trade, and finance courses alike.

For policymakers, the implication is not that tariffs always weaken the dollar; it’s that credibility, composition, and retaliation determine the sign. If the goal is to rebuild the tradable base without sacrificing the dollar’s safety premium, three design choices matter. Scope must be narrow, security-grounded, and sunset-dated so private investment can price the rules. Protection must be tied to contestable, performance-conditioned subsidies that expand capacity quickly rather than to open-ended levies. And diplomacy must favor compacts that swap lower, stable tariffs for verifiable U.S.-bound investment, as emerging deals with Japan and South Korea aim to do—capping auto tariffs around 15% in exchange for large U.S. investment packages—even if the fine print and timelines remain in flux. This is not nostalgia for laissez-faire; it is recognition that in a services-heavy, supply-chain world, credibility is a key component of industrial policy.

We should also retire the comforting notion that tariffs can finance re-industrialization with painlessly considerable revenue. Neutral scorekeepers note that the effective tariff rate surged after April 2, with modeled household purchasing-power losses in the short term; separate trackers emphasize that U.S. importers pay the revenue and pass it through unevenly to consumers. Meanwhile, the real economy offers a sober cross-check: factory output has stalled at the margin in recent months and utilization remains below average, underscoring that capacity takes time to build even when incentives are strong. Tariffs can play a role, but a blanket levy first, followed by investment details later, is a credibility-destroying sequence—one that markets will keep marking down.

A final word on modeling. The most promising new research embeds retaliation, invoicing, and portfolio channels alongside trade elasticities. VoxEU’s September synthesis argues that dollar depreciations after major tariff shocks are “not so surprising” once those channels are in the frame, and the BIS paper formalizes how fast the initial shock was absorbed as carve-outs and deals accumulated. The practical test for any framework is whether it helps us map policy to market moves in real time. In April, appreciation predictions relied on three conditions—ample domestic manufacturing headroom, exporters absorbing tariffs, and an unruffled reserve premium—that did not obtain. A reframed approach begins with what we can observe quickly: incidence at the border, capacity constraints, retaliation risks, and convenience yield shifts in the bond market. Those four facts explain far more of 2025 than the older story.

A weaker dollar after a major tariff shock, culminating in the worst first-half performance in half a century. The lesson is not that theory failed us; it is that we used the wrong theory for the world we inhabit. In an economy with a small, capacity-tight manufacturing core and globally entangled supply chains, broad tariffs act like a domestic sales tax before they function as an industrial strategy. When they trigger retaliation and erode the safety premium on long Treasuries, capital leaves or shortens duration, and the currency softens. The repair plan is straightforward: narrow the scope, publish the arithmetic, bind protection to capacity-building investment, and rebuild the bond market’s trust. If we want a stronger dollar and a stronger tradable base, we must start by designing a credible policy—one that the world can price.

The views expressed in this article are those of the author(s) and do not necessarily reflect the official position of the Swiss Institute of Artificial Intelligence (SIAI) or its affiliates.

References

Acharya, V. V., & Laarits, T. (2025). Tariff War Shock and the Convenience Yield of U.S. Treasuries—A Hedging Perspective. NYU Stern Working Note (April 23, 2025).

Amiti, M., Redding, S. J., & Weinstein, D. E. (2020). Who’s Paying for the U.S. Tariffs? AEA Papers & Proceedings, 110, 541–546.

Bank for International Settlements (2025). Market whiplash after the 2025 tariff shock: an event study (Working Paper No. 1282).

Bureau of Economic Analysis (2025). Value Added by Industry: Manufacturing as a Percentage of GDP (VAPGDPMA).

Federal Reserve Board (2025). Industrial Production and Capacity Utilization (G.17), July update.

Financial Times (2025, June 30). U.S. dollar suffers worst start to year since 1973.

International Monetary Fund (2025, April). Global Financial Stability Report, Chapter 1.

Peterson Institute for International Economics (2025). Tariff Revenue Tracker; Household Impact of Trump’s Tariffs.

Reuters (2025, April 3). Dollar sinks as investors grapple with tariff aftermath.

Reuters (2025, Jun–Aug). Japan and South Korea tariff-investment deals; auto sector pricing and margins.

U.S. Census Bureau (2025). Top Trading Partners, July 2025 (goods basis).

Federal Reserve Bank of Dallas (2025). China remains a modest player in U.S.–Mexico trade despite surging re-exports.

VoxEU/CEPR (2025, Apr 15). Tariffs, the dollar, and equities: High-frequency evidence from the “Liberation Day” announcement.

VoxEU/CEPR (2025, Sep 3). Tariffs and U.S. dollar depreciations: Not so surprising after all.

Comment