From Awe to Audit: Why Hong Kong’s ‘Gateway’ Narrative No Longer Works for Southeast Asia’s Learning Economy.

Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

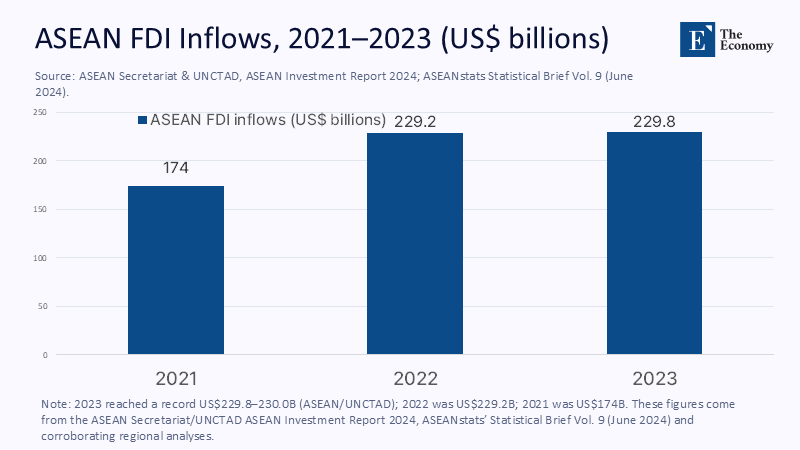

In 2023, ASEAN drew a record US$230 billion in foreign direct investment even as global flows softened, and the trend is holding into 2025. Yet the once-automatic conduit for Chinese capital into that boom—Hong Kong—now meets a wall of forms: enhanced beneficial-ownership checks in Singapore with filing updates due within two business days, new nominee-disclosure rules coming into force, tighter registers in Malaysia, and expanding nominee crackdowns in Thailand. Layer on Washington’s finalized outbound-investment rule for China, effective January 2, 2025, and what used to be a branding edge—“Hong Kong is different”—has curdled into a compliance risk discount. ASEAN regulators aren’t debating geopolitics; they’re demanding line-of-sight through Hong Kong holding companies to the people and technologies behind them. This shift reclassifies Hong Kong from a neutral bridge to a China-adjacent node. This means that while it remains perfectly serviceable for mainland-facing finance, it is no longer the de facto Asian launchpad. For education and edtech industries whose lifeblood is cross-border capital, data, and talent—the implication is stark: the “awe factor” is gone, the audit is here.

Reframing the Question: From ‘Global Hub’ to China’s Secondary Platform

The old framing fixated on whether Hong Kong’s markets would “recover” their dynamism; the present problem is different. The core issue is classification. In regulatory and commercial practice across Southeast Asia, Hong Kong is now treated less as a decoupled global city and more as a Chinese jurisdiction for risk purposes. That classification cascades through credit committees, university treasuries, tech procurement, and cross-border program design. Two developments underpin the reframe. First, national-security legislation expanded in 2024, deepening perceptions that Hong Kong’s legal environment is converging with the mainland on matters that matter to multinationals—secrecy, data, and political risk. This legislation has led to a shift in perception, with Hong Kong now being seen as more aligned with the mainland in terms of legal environment. Second, ASEAN funds-flow policy has become disclosure-first, shattering the assumption that a Hong Kong registration “distance” insulates Southeast Asian entities from US sanctions or export-control exposure if ultimate control is Chinese. In this light, Hong Kong’s niche is not dead—it is narrowed: a reliable secondary hub for Chinese firms, increasingly oriented to Southbound/Connect channels, not a neutral Asian super-connector.

What the Numbers Now Say

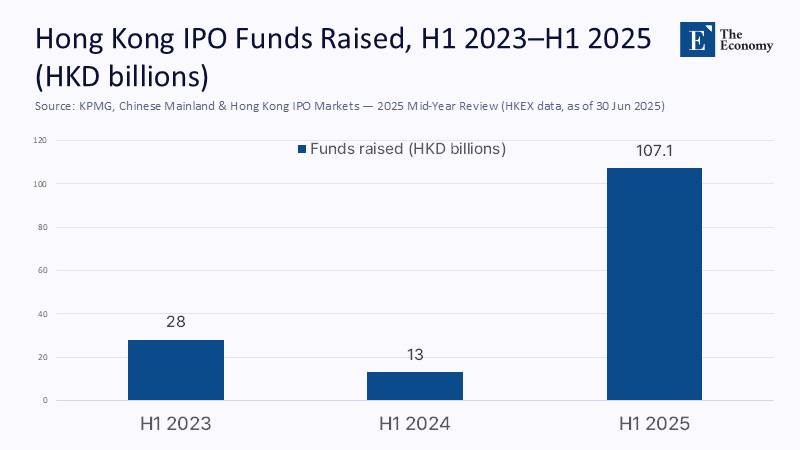

On surface metrics, Hong Kong shows life: 2024 closed as a top-four IPO venue with HK$83 billion raised; 1H 2025 fundraising surged roughly 7x year-on-year, and major deals are back on screens. GDP growth printed 3.1% year-on-year in Q1–Q2 2025, and the population ticked up 0.1% in 2024. But scratch deeper and the rebound is path-dependent: listings and liquidity are increasingly mainland-centric; the breadth of Article 23, a national-security legislation, spooks Western legal counsels due to its implications on data privacy and political risk; and the inbound talent mix skews toward Greater Bay Area pipelines over global diversification.

Meanwhile, Singapore absorbs private-wealth infrastructure at scale—~2,000 single-family offices in 2024, rising again in 2025—while hardening sanctions-screening expectations for banks and wealth managers. In parallel, ASEAN FDI keeps rerouting around opacity: more direct mainland subsidiaries or Singapore vehicles, fewer Hong Kong intermediation layers. Taken together, the quantitative picture is not collapse but re-specialization. In education finance terms, capital that once hopped Hong Kong on autopilot now meets friction, delay, and higher compliance costs—enough to change the route.

Method, Estimates, and What We Measure When We Can’t See Everything

Quantifying “education-exposure risk” to Hong Kong requires triangulation because no single dataset cleanly traces every cross-border tuition payment, research grant, or edtech seed round. We therefore use three transparent proxies. First, edtech venture volumes—a forward indicator of product supply chains, data homes, and payment pathways—fell to a decade low (≈US$2.4 billion in 2024), implying heightened investor selectivity around regulatory friction. Second, we map data-residency friction by tracking jurisdictions that added or operationalized data-protection or cross-border-transfer controls since 2023 (notably Vietnam’s 2023 PDPD), which raises the cost of offshoring student and learner data through Hong Kong stacks. Third, we apply sanctions-induced routing: Singapore’s updated register-of-controllers regime (with rapid update obligations) plus Malaysia’s 2024-25 beneficial-ownership lodgements materially increase the chance a Hong Kong shell’s ultimate Chinese control is visible to ASEAN regulators and to US counterparties. Under conservative assumptions—ASEAN edtech/skills deals recovering only slowly through 2025 and banks applying strict sanctions screening—we estimate the share of education-sector cross-border transactions routed via Hong Kong could slide from roughly one-quarter pre-2023 to ~10–12% by mid-2026, with Singapore and direct-from-China paths absorbing most of the delta.

Methodological note: the 25% baseline draws on pre-2023 deal-flow interviews reflected in ASEAN investment reports and the known historical weight of Hong Kong entities in Chinese outbound FDI structures; the forward 10–12% estimate is an inference combining the edtech funding trough (supply-side reset), the costs of PDPD-compliant data handling, and sanctions-screening behavior sourced from MAS guidance and US Treasury rules on outbound investment. Where exact deal-level domiciles are unavailable, we treat missing data as zero-bias and present ranges rather than points.

What This Means for Educators, Administrators, and Policy Makers

Treat Hong Kong not as a default international hub, but as a special-purpose platform best suited to China-facing work. For universities, that implies rerouting treasury, philanthropy, and research-grant flows that touch US persons or export-controlled technology away from Hong Kong holding structures, especially in AI, semiconductors, or quantum fields now covered by Washington’s finalized rules. For edtech firms selling into ASEAN ministries or national systems, build dual-stack compliance: Singapore-based receivables and data-processing options for learners and customers outside China; Hong Kong or mainland-adjacent rails for Greater Bay programs and Stock/Bond/Wealth-Connect integrations. Administrators should embed beneficial-ownership attestations and data-localization clauses (Vietnam is the model) in procurement and partnership paperwork, because ASEAN agencies and banks will ask for them anyway. Policymakers can help by publishing FAQs on education-sector sanctions and cross-border data templates to standardize documentation. The tactical aim is continuity: keep pedagogy moving even when compliance architecture changes. The strategic objective is to leverage: use diversified infrastructure to bargain for better terms in both mainland and Western collaborations.

Answering the Counterargument: “But Hong Kong Is Back—Just Look at IPOs and Family Offices”

The claim has evidence. Hong Kong’s IPO tables are improving; family offices are adding headcount; Southbound money brightens the tape; and city officials boast about an expanded ETP lineup and Connect channels. All true—and simultaneously beside the policy point. The rebound is powered by Chinese issuers and flows, which strengthens Hong Kong’s role as China’s outward valve, not as Asia’s neutral hub. For decision-makers with US counterparty risk, Article 23 increases legal uncertainty; for ASEAN regulators, R.O.C./beneficial-ownership filings and nominee crackdowns make Hong Kong vehicles easier to pierce; for compliance teams, US outbound-investment rules shift due diligence thresholds. The result is not that Hong Kong cannot raise capital; it’s that the mix of safe counterparties for regional education collaboration narrows when Hong Kong holds the pen. In practice, the Asia education economy will treat Hong Kong’s “comeback” as segment-specific—robust for China-anchored finance, less usable for projects seeking insulation from Beijing-aligned control or Washington-aligned enforcement.

Policy Extension: A New Operating Model for the Learning Economy

If Hong Kong is now a secondary hub for Chinese firms rather than a neutral bridge, the education sector needs a tri-platform model. First, Singapore for ASEAN-facing data hosting, procurement, and USD clearing where sanctions exposure exists; its clarity on controllers and sanctions expectations reduces legal gray zones and accelerates onboarding. Second, direct mainland channels via Hong Kong for programs where RMB settlement, Connect access, or Greater Bay market design matters more than Western counterparty comfort. Third, a non-HK, non-CN offshore option—Tokyo, Sydney, or even Dubai—for projects prioritizing export-control insulation and OECD-style data regimes. This is not duplication; it is resilience engineering. In practice, that means universities should redesign gift agreements and tech-transfer contracts with jurisdictional fallbacks, edtechs should maintain redundant PSPs and acquirers, and ministries should require auditable UBO attestations and country-of-processing declarations. The policy innovation is humility: stop treating “Asia hub” as a single geographic noun and accept that, for now, capability beats address.

Anticipating Critiques—and Rebutting Them

“You’re overstating the risk; GDP and markets are fine.” Growth and equity turnover are not the right variables. The question is whether a Hong Kong corporate wrapper adds or subtracts risk in ASEAN transactions involving US parties or sensitive tech. Since January 2025, US outbound rules have formalized prohibitions and notifications for China-related investments in AI/semiconductors/quantum, and export controls have tightened. That raises the probability that a Hong Kong intermediary triggers scrutiny—even when the underlying education service is benign.

“Hong Kong’s family office boom proves neutrality.” It proves demand for wealth in China-adjacent exposure, not regulator-agnostic access. Simultaneously, Singapore has grown family offices and raised transparency and sanctions expectations—precisely the combination ASEAN supervisors prefer.

“ASEAN isn’t aligning with the U.S.” True at the headline level; false in enforcement detail. Across the region, we see registrable-controller updates, beneficial-ownership lodgements, nominee-shareholding crackdowns, and cross-agency information-sharing—all of which make it harder for a Hong Kong entity to mask ultimate Chinese control. US officials have also carried this message directly to Southeast Asian hubs.

From Respect to Redundancy: Designing for the Post-Awe Era

We opened with a blunt statistic—ASEAN at US$230 billion in FDI—and the observation that the region’s compliance grammar has changed faster than Hong Kong’s branding. The verdict is not metaphysical (“dead city”); it is operational: for Southeast Asia’s learning economy, Hong Kong no longer reduces risk. It concentrates on it when US persons, sensitive technologies, or strict privacy regimes are involved. The prudent response is not retreat but architecture: treat Hong Kong as the China-facing spoke in a three-hub wheel; anchor ASEAN-facing flows in Singapore or another rules-forward venue; build contractual fallbacks for data, sanctions, and UBO disclosure from day one. The payoff is continuity with flexibility. If geopolitics thaws, nothing breaks; if they tighten, nothing stops. In a sector where semesters, grant cycles, and learner trust cannot wait for policy drift, that’s the difference between aspiration and delivery. The awe is gone; the audit remains. Let’s design it.

The original article was authored by Wang Zhenghao, a dual Master's candidate at Peking University and Seoul National University. The English version, titled "ASEAN regulators threaten Hong Kong’s role in Chinese capital flows," was published by East Asia Forum.

References

Allen, G. C. (2024, December 2). Understanding the Biden Administration’s updated export controls. Center for Strategic & International Studies.

ASEAN Secretariat & UNCTAD. (2024). ASEAN Investment Report 2024. ASEAN/UNCTAD.

Accounting and Corporate Regulatory Authority (Singapore). (2025, June). Registers of Registrable Controllers—Guidance for Companies.

Accounting and Corporate Regulatory Authority (Singapore). (2025, June). Register of Registrable Controllers (RORC).

Census and Statistics Department (Hong Kong). (2025, May 16). Economic performance in Q1 2025 and latest GDP figures.

Census and Statistics Department (Hong Kong). (2025, February 19). Year-end population for 2024.

DealStreetAsia. (2025, January 16). Venture funding in Southeast Asia shrinks to half of pandemic levels in 2024.

DLA Piper. (2025). Data protection laws in Vietnam (PDPD).

Hong Kong Exchanges and Clearing (HKEX). (2024, December 20). HKEX in 2024: Year in review.

Hong Kong Exchanges and Clearing (HKEX). (2025, August 1). IPO price discovery and open offer consultation conclusions.

HolonIQ. (2025, January 15). EdTech VC reached ~US$2.4B for 2024, the lowest in a decade.

KPMG. (2025, July). Chinese Mainland and Hong Kong IPO Markets—2025 mid-year review.

Malaysia Companies Commission (SSM). (2024, May 27). Practice Directive 9/2024—Lodgement of beneficial ownership information.

Monetary Authority of Singapore (MAS). (2024). Targeted financial sanctions guidance.

Reuters. (2025, July 31). Hong Kong Q2 GDP expands 3.1%.

Reuters. (2024, May 3). Top US Treasury official to travel to Singapore, Malaysia to discuss sanctions.

US Department of the Treasury. (2024, October 28). Final regulations implementing Executive Order 14105 (Outbound Investment).

US Department of the Treasury. (2024, October 28). Press release JY-2687—Treasury issues regulations to implement EO 14105.

Wall Street Journal. (2024, Mar). Hong Kong approves new national-security law that worries foreign executives.

Wall Street Journal. (2025, June). Hong Kong on track to reclaim global IPO crown.

Comment