Moderate quakes cause deep, unpriced losses through financing gaps Price mid-risk and pre-fund rapid recovery with layered instruments Trigger cash to schools to cut spreads and speed rebuilding Earthquakes are a relentl

Read More

Strong laws; complex compliance stalls EU growth Simplify: one rulebook, one portal, safe patterns Tie public compute to pre-cleared controls; update annually EU’s digital rules now have teeth.

Read More

Japan’s chip revival must be talent-first Play niches—packaging, sensors, photonics—over a scale race Tie subsidies to audited workforce and yield outcomes The scariest number in the chip biz isn't about cash or size.

Read More

Real home prices are slipping—rents cooling and high costs signal housing price deflation Agglomeration can’t beat affordability limits or hybrid work Plan for gentle deflation: lock cheaper leases, support incomes, keep building

Read More

WTO paralysis spurs tariffs and subsidies—an industrial policy arms race Replace blanket tariffs with evidence-based, sunset countervailing duties Prioritize resilient skills; publish subsidy math to restore trust By 2025, t

Read More

China blocks stablecoins to guard monetary control Goal: curb capital flight and AML risks; push users to e-CNY/mBridge Ed-tech: use bank rails and e-CNY in China; stablecoins only abroad So, here’s the deal:

Read More

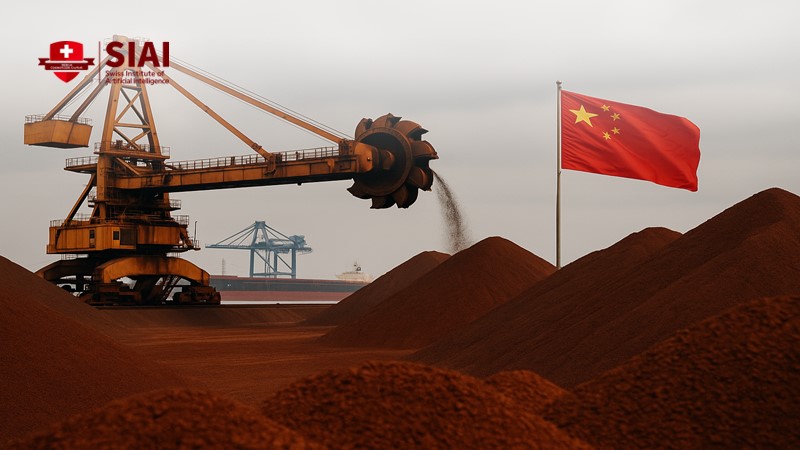

China centralizes iron ore power Simandou adds leverage and options Train procurement to protect budgets In late 2025, China, which accounts for almost three-quarters of the world's seaborne iron ore trade, showed its str

Read More

48-hour takedowns for non-consensual deepfakes Narrow guardrails curb abuse, not innovation Schools/platforms: simple, fast reporting workflows Deepfake abuse is a vast and growing problem.

Read More

Teen chatbot safety is a public-health issue as most teens use AI daily Adopt layered age assurance, parental controls, and a school “teen mode” with crisis routing Set a regulatory floor and publish safety metrics so safe use becomes the default

Read More

EU freezes ~€210bn; windfall profits flow, not principal Route proceeds via EU/G7 loans to steady, education-first support Preserve trust: strict legality, transparency, shared risk A single number now shapes the conversatio

Read More

Omnibus simplification risks deepening Big Tech lock-in Bind it to portability, open APIs, and switching If others copy, copy the guardrails—not consolidation Europe spent roughly €61 billion on cloud services

Read More

EU-Bonds cost more than Bunds due to design and index rules Make them sovereign: permanent issuance, one agency, hedging tools, clear own resources Tighter spreads free billions for education and investment In mid-2025, the European

Read More

Nationalist politics inflates Japan–China business costs, risking $292.6B in trade Controls and bans snarl inputs, travel, and seafood, squeezing factories and SMEs The fix: de-risk, don’t decouple—transparent dashboards, precise licenses, targeted insurance

Read More

The fiscal sentiment multiplier can crowd in investment—if credit is open and demand credible Japan’s new stimulus tests this channel amid record debt, higher yields, and shaky confidence Aim spending at skills-linked, high-productivity sectors to avoid over-investment and lock in growth

Read More

AI slop is flooding education and hiring, drowning out real skill Fix the system by verifying process—observed writing, evidence-linked claims, and a short oral defense Set provenance standards and incentives so accountable, source-grounded work beats paste

Read More

Capitals dominate because jobs concentrate, not because productivity lags elsewhere Move demand and decision rights to secondary cities to thicken labor markets Align education pipelines and public procurement to reward distributed hiring and retention

Read More

Shocks drain savings and push retirees to Medicaid Make LTC countercyclical: shock-based eligibility, rapid HCBS, reinsurance Pre-fund modest universal benefits to slow spend-down and keep care at home A

Read More

Chinese EVs are cheaper due to scale, supply chains, and subsidies Targeted EU tariffs and price floors correct subsidy-driven undercutting Link trade defense to localization, skills, and investment to protect competitiveness

Read More

Ageing Europe needs an optimal immigration level Set ~0.6–1.0% yearly, adjusted by jobs, housing, and language Link flows to capacity and invest to keep growth and trust Across the EU, the old-age dependency

Read More

Closing gender and 60+ gaps offsets ageing Frontiers need more hours; laggards need jobs and childcare Use 5-year targets, neutral taxes, late-career training In 2024, the European Union still had a gender employment gap of 1

Read More